US financial development was somewhat lower in the second from last quarter than recently detailed, yet hearty, highlighting the sheer strength of America’s economy throughout the late spring.

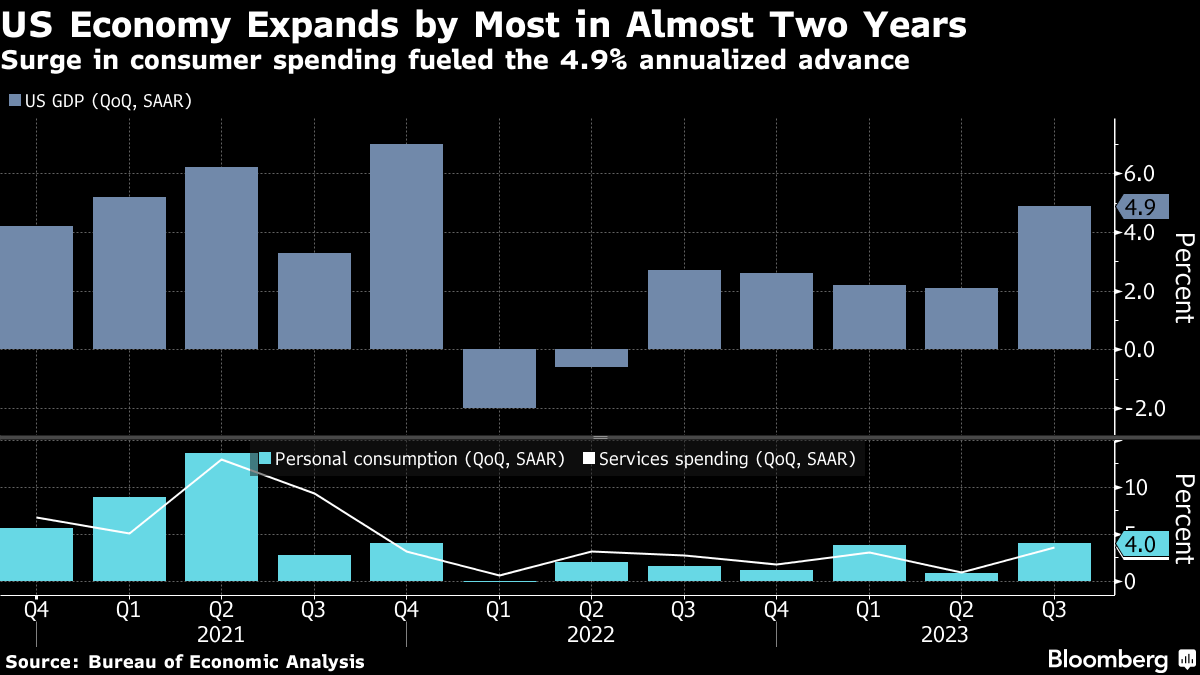

GDP, the broadest proportion of monetary result, extended at an annualized 4.9% rate from July through September, the Trade Division revealed Thursday. That is a more slow speed of development than the 5.2% detailed in the subsequent gauge.

Development in the second from last quarter was the most grounded in almost two years as Americans spent on live shows, movies, and products. The US economy has eased back from the scorching speed set before in the year, however both recruiting and spending stay strong.

The office’s last gauge figured in more fragile customer spending, stock speculation and products, while reexamining government costs and business venture higher. Shopper spending, which represents around 66% of monetary result, was reconsidered down to 3.1% from 3.6%.

Financial backers are bullish that the Central bank is ready to cut loan costs in only a couple of months, however authorities have as of late pushed back on that confidence. Some likewise accept the economy is amidst nailing a delicate finish, a situation where expansion gets back to the Federal Reserve’s 2% objective without a sharp ascent in joblessness.

Lower loan fees not too far off

Rate slices appear to be all the rage these days. The Federal Reserve’s most recent arrangement of financial projections delivered before this month showed that national bank authorities have planned for three rate cuts one year from now.

Financial backers and the Federal Reserve are feeling much better that expansion is facilitating again after momentarily getting prior in 2023. The firmly watched Purchaser Value List rose 3.1% in November from a year sooner, down from October’s 3.2%. The CPI bounced up to 3.7% in the late spring because of rising energy costs, which have fallen strongly lately.

The Business Division discharges November information on family spending, pay and the Federal Reserve’s favored expansion check Friday.

What’s not satisfactory is when rate cuts will eventually start. That originally cut could come in Spring, as per prospects. Yet, Took care of authorities have been attempting to give invigorated markets a rude awakening.

“We aren’t actually discussing rate cuts,” New York Took care of President John Williams told CNBC as of late.

Chicago Took care of President Austan Goolsbee let CBS Sunday know that expansion stays above target and that “it’s an exaggeration to count the chickens.”

A strong US economy… until further notice

The more extensive economy has remained strikingly tough, and keeping in mind that it has mellowed since the mid year, it hasn’t tumbled off a precipice.

Some believe America’s monetary strength might have confounded the Federal Reserve’s occupation of packing down expansion further. In any case, cost climbs kept on cooling after the late spring.

The Atlanta Took care of is presently projecting final quarter Gross domestic product to enlist at 2.7%, a more fragile speed of development than in the earlier three-month time frame, yet strong.

The US economy’s strength notwithstanding the most elevated loan fees in 22 years has raised trusts that the Fed might be on the cusp of accomplishing a generally troublesome errand: crushing expansion without lifting joblessness.

“An impossible ‘delicate arriving’ for the US economy appears to be more probable one year from now,” John Min, boss financial expert at Monex USA, wrote in a new note.

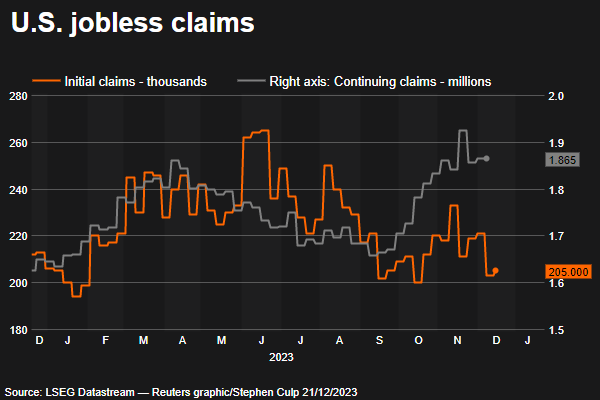

New applications for joblessness help, which ordinarily extend to early indications of any changes in the employment opportunity market, stay low. Jobless cases ticked higher last week yet came in underneath the thing financial experts were anticipating.

There were 205,000 introductory cases for joblessness protection during the week that finished on December 16. That is up 2,000 from the earlier week’s upwardly reconsidered all out of 203,000, the Labor Division said in a different report Thursday.

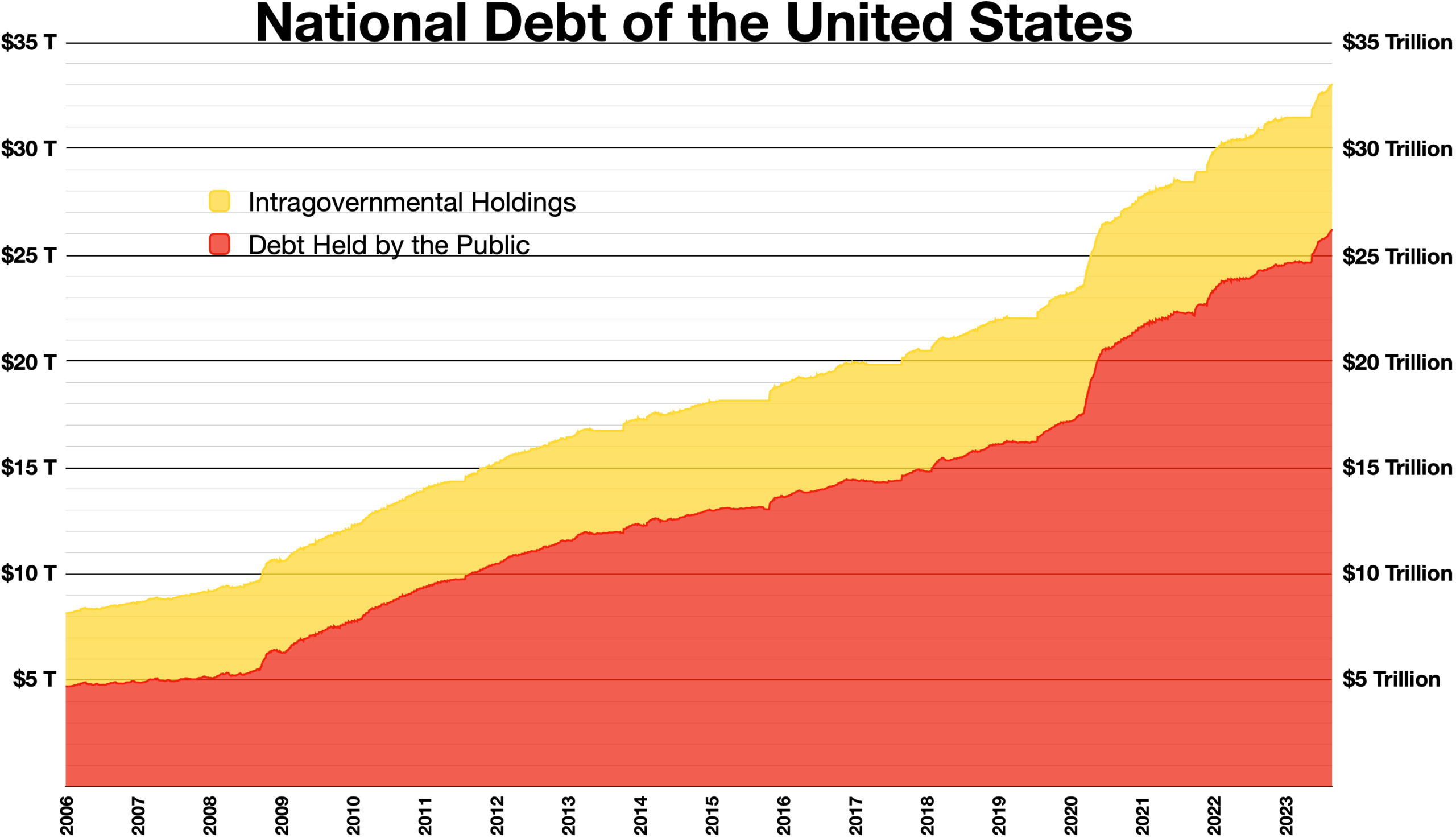

All things considered, a huge number of monetary obstacles lie ahead. Americans keep on piling up unpaid liability as they draw down their pandemic reserve funds. Almost 9,000,000 Americans missed their most memorable understudy loan installment after the pandemic-related stop finished this fall.