The Central bank will slice interest rates by an eye-popping 275 premise focuses one year from now, as indicated by UBS.

That is almost multiple times however steep a slice as the market seems to be anticipating.

UBS anticipates that a mid 2024 recession should urge the national bank to begin facilitating.

The US economy will slip into recession one year from now – and that will prompt the Central bank acquiring steep interest-rate cuts, as indicated by one top European bank.

UBS expressed back in November that it’s anticipating that the Fed should answer falling expansion and a monetary downturn by cutting rates by an eye-popping 275 premise focuses – almost multiple times the 75-premise point decrease the market is right now expecting, per the CME Gathering’s Fedwatch device.

“One of the vital highlights of UBS’s conjecture is the extremely articulated Taken care of facilitating cycle seen unfurling from Walk 2024 onwards,” a group drove by financial expert Arend Kapteyn and specialist Bhanu Baweja said in an exploration note distributed mid-November, adding that they anticipate that rates should plunge to just 1.25% in the principal half of 2025.

The Federal Reserve’s cuts would be “a reaction to the guage US recession in Q2-Q3 2024 and the continuous log jam in both title and center expansion,” UBS added.

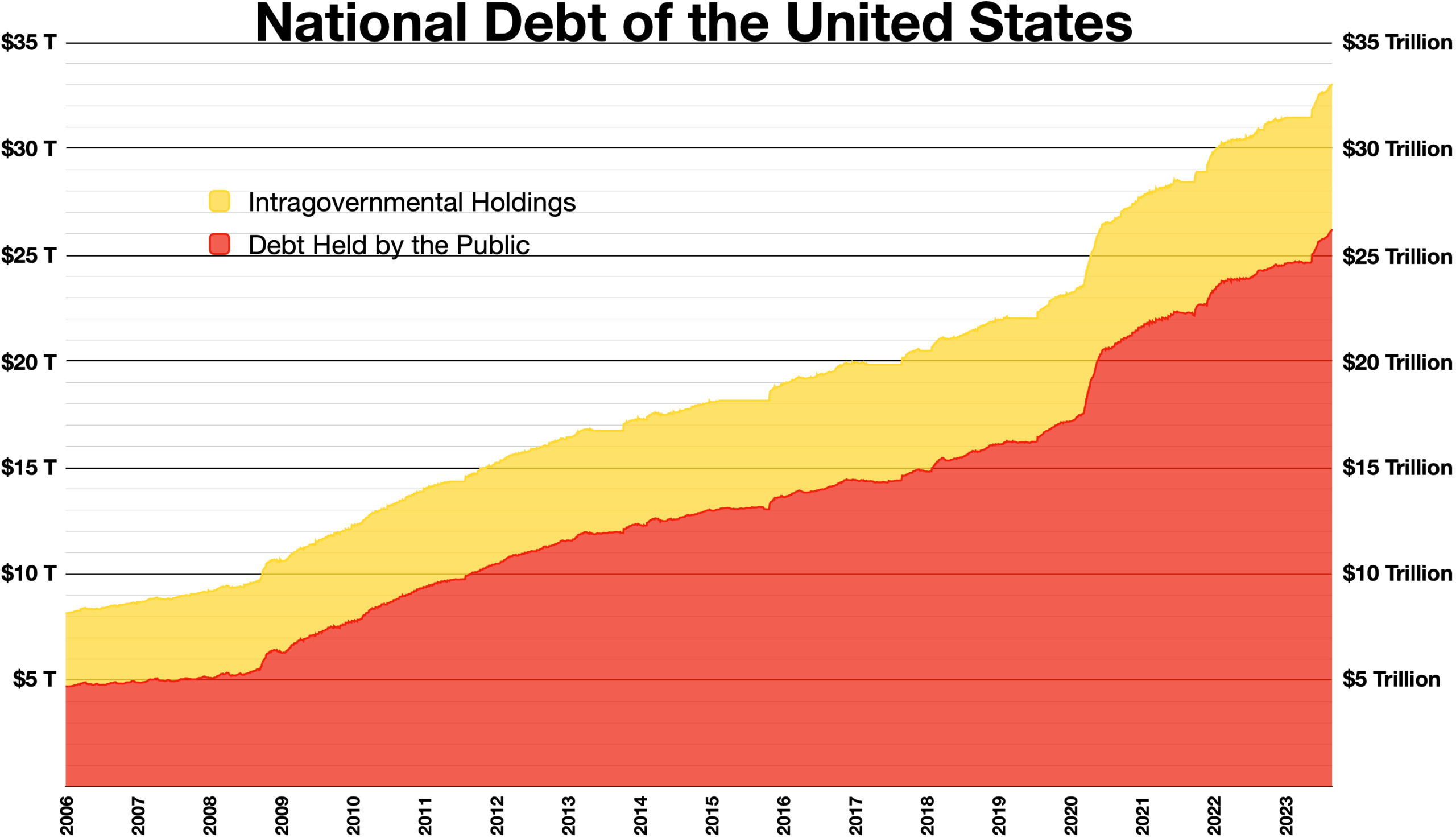

Since Walk 2022, the Fed has lifted getting costs from close to zero to around 5.5% in a bid to cinch down on taking off costs. Expansion hit a four-decade high of 9.1% in June last year, however has since begun to cool – in spite of the fact that it’s actually running way clear of the national bank’s 2% objective.

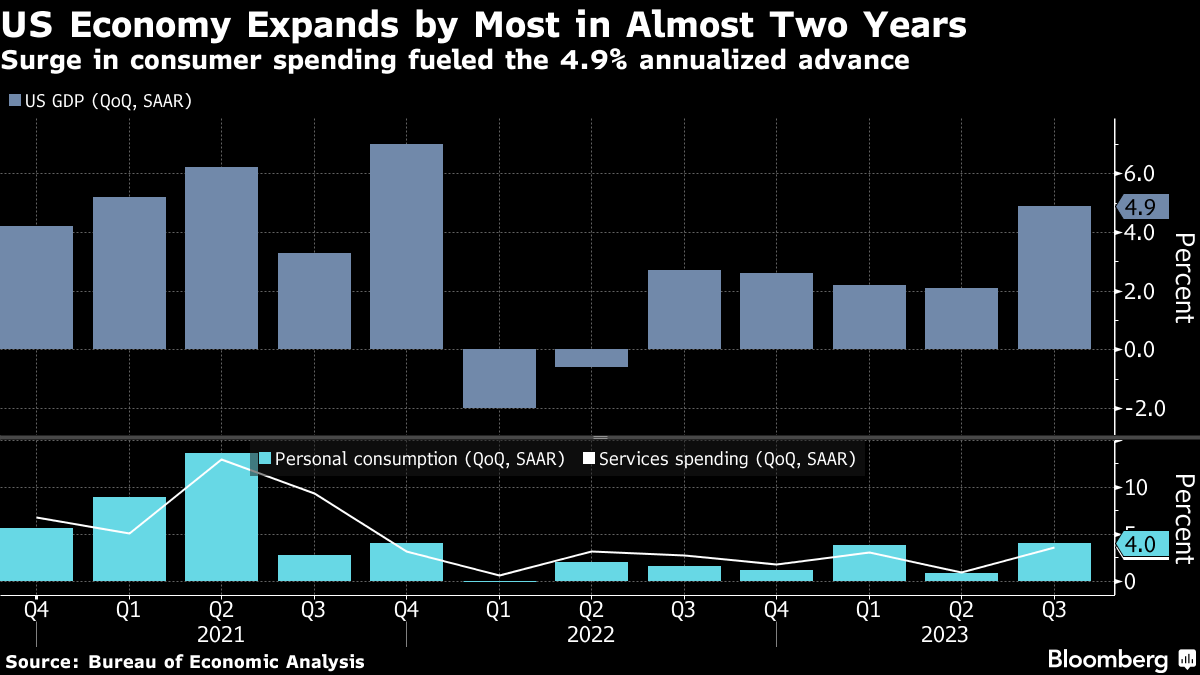

That fixing effort would be supposed to burden the economy, yet the US has stayed away from a recession up to this point. The nation’s GDP extended 4.9% in the second from last quarter, for its most elevated development rate in two years.

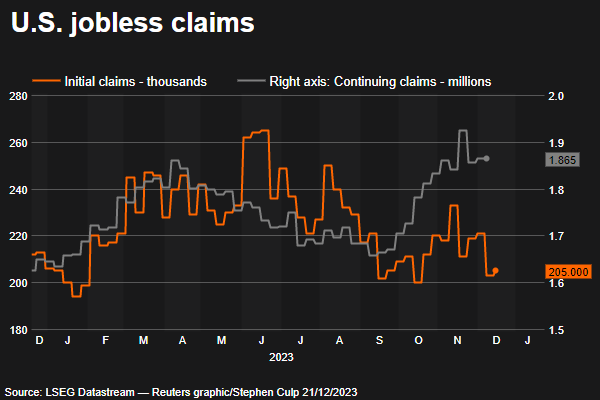

In the mean time, the positions market has likewise held up despite the Federal Reserve’s interest-rate climbs, with the joblessness rate sneaking up as of late yet drifting beneath 4%.

The recession expectation spread out by Kapteyn and Baweja seems to conflict with a different viewpoint shared by UBS’s head of resource designation for the Americas.

Jason Draho said in a show that the US economy’s astounding strength this year has made way for a “thundering ’20s” period characterized by higher Gross domestic product development, expansion, security yields, and interest rates.