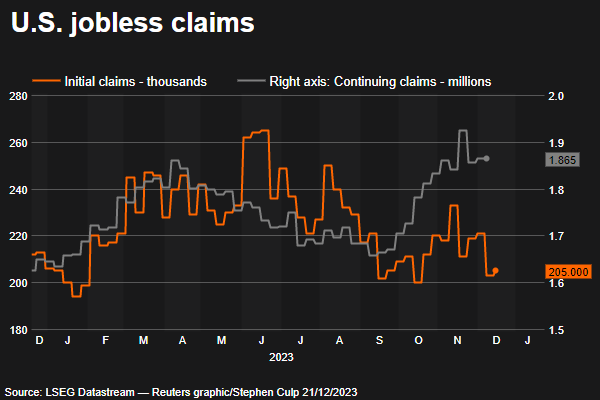

There’s just a single suitable word to depict the U.S. economy in 2023: “supernatural occurrence.” Numerous specialists said a downturn was unavoidable. They said it was basically impossible that expansion would ease without monstrous employment misfortunes. They were off-base. In addition to the fact that there was no downturn in 2023, yet development advanced rapidly as the year advanced. Expansion cooled forcefully (from 6.4 percent to 3.1 percent), and the economy added more than 2.5 million positions. This doesn’t mean everything was great, yet it’s vital to commend what might be compared to a longshot competitor winning gold. Also, to inquire: How could it work out?

The most direct clarification is that it took much longer than nearly anybody anticipated to fully recover after the pandemic. Expansion likewise ended up being to a great extent caused by supply issues. That is strange. Regularly, request makes costs spike. The Central bank then, at that point, climbs loan fees to kill interest, yet this regularly brings challenging task misfortunes and a downturn. This round was different in light of the fact that, after the pandemic, it required a long investment to fix supply chains. Furthermore, there was a labor supply issue, as it required a long time to return an adequate number of individuals once again to work. As supply misfires lessened in 2023, expansion died down around the world.

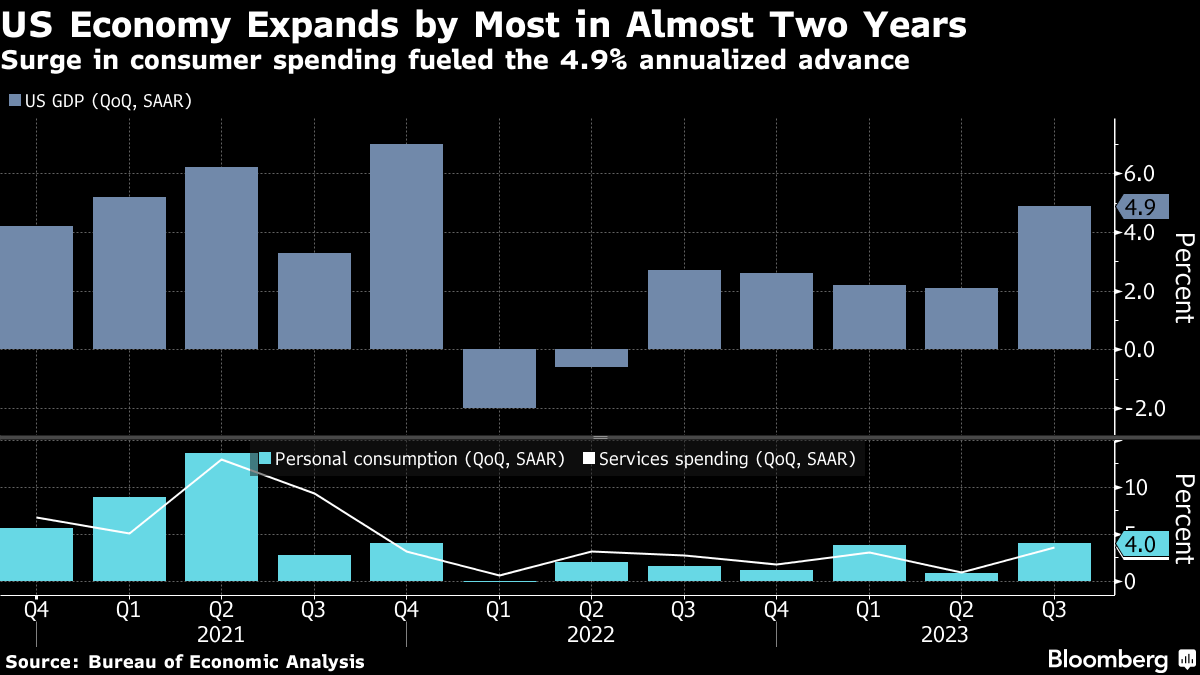

This isn’t the full story in the US. Americans kept their spending binges going the entire year. This, as well, was a major shock. Specialists had anticipated spending would plunge as individuals exhausted their pandemic reserve funds, and surveys showed that Americans were miserable, rating this economy as “fair” or “poor.” Yet individuals continued to spend like the economy were blasting. JPMorgan ran the numbers and observed that Americans are spending more now than they did before the pandemic, even in the wake of adapting to expansion. This isn’t going on somewhere else on the planet. In Europe and Japan, for instance, shoppers are spending equivalent to they did pre-pandemic.

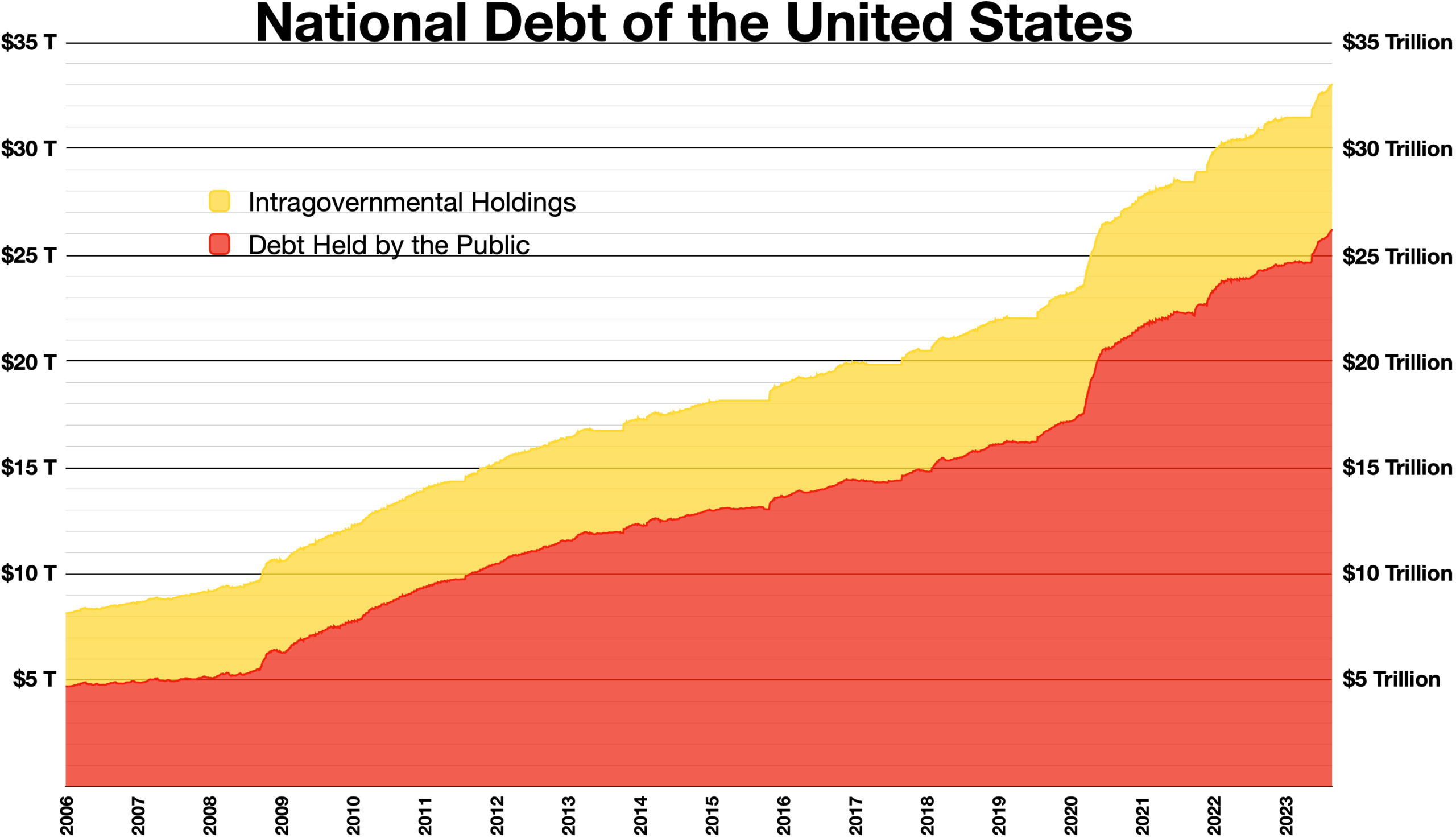

The enormous U.S. government boost plainly worked. It supported reserve funds and kept millions out of destitution during the most obviously terrible of the pandemic. It likewise energized quick rehiring, which gave individuals greater salaries to spend. Different nations had solid financial reactions too, yet the US’s was quite possibly of the greatest.

Something more was additionally impacting everything: as of late, Americans have become richer, and in addition to the rich. Families across the pay range have seen the biggest flood in abundance on record. This was driven basically by a flood in the U.S. securities exchange (almost 60% of families currently have some stock possession, by and large by means of retirement funds) and a massive ascent in home estimations. By far most of property holders secured in contract rates under 5%, which protected them from the Central bank’s agonizing rate climbs. (Most different nations don’t secure in a home loan rate for a long time, and this allows their mortgage holders undeniably more to remain uncovered to financing cost climbs.) In the mean time, U.S. home estimations took off. Individuals feel more well off, regardless of whether they haven’t really sold their homes or stocks. At the point when individuals feel richer, they will generally spend more.

It’s the abundance pattern that separated the US from the remainder of the world and that wasn’t completely perceived when specialists made their 2023 expectations, as per the JPMorgan examination by Joseph Lupton and Maia Convict. Obviously, numerous youngsters currently can’t bear to purchase their most memorable homes. In any case, 66% of Americans currently own homes.

While different nations have seen abundance rise, the leap has been particularly high in the US. The abundance impact makes sense of why Americans have been open to accomplishing such a great deal extra going a little overboard on everything from gems to Taylor Quick and Beyoncé tickets.

So who gets the credit for this? The response will be bantered for a really long time. Congress and President Donald Trump acted quickly with the underlying guide. President Biden established an extra $1.9 trillion improvement in 2021 that kept financial force building. The Fed kept rates low in 2020 and 2021, which squeezed the lodging and financial exchanges, and afterward climbed rates quickly. Corporate pioneers made weighty ventures that helped efficiency. Laborers (particularly ladies) flooded once more into the labor force, reducing the labor crunch. Then, at that point, there was the continuous get back to business as usual after the pandemic and the eccentricities of the U.S. real estate market.

This large number of elements assumed a part. In any case, the US got a marvel while most different countries had a “meh” year on the grounds that the US had a greater upgrade and outsize lodging gains.

While spending will probably sluggish in 2024, be cautious wagering against the U.S. purchaser. With respect to Biden, he merits more recognition than he’s getting.