WASHINGTON, Dec 21 (Reuters) – The quantity of Americans documenting new cases for joblessness benefits rose hardly last week, the most recent idea that the economy was recovering some energy as the year slows down.

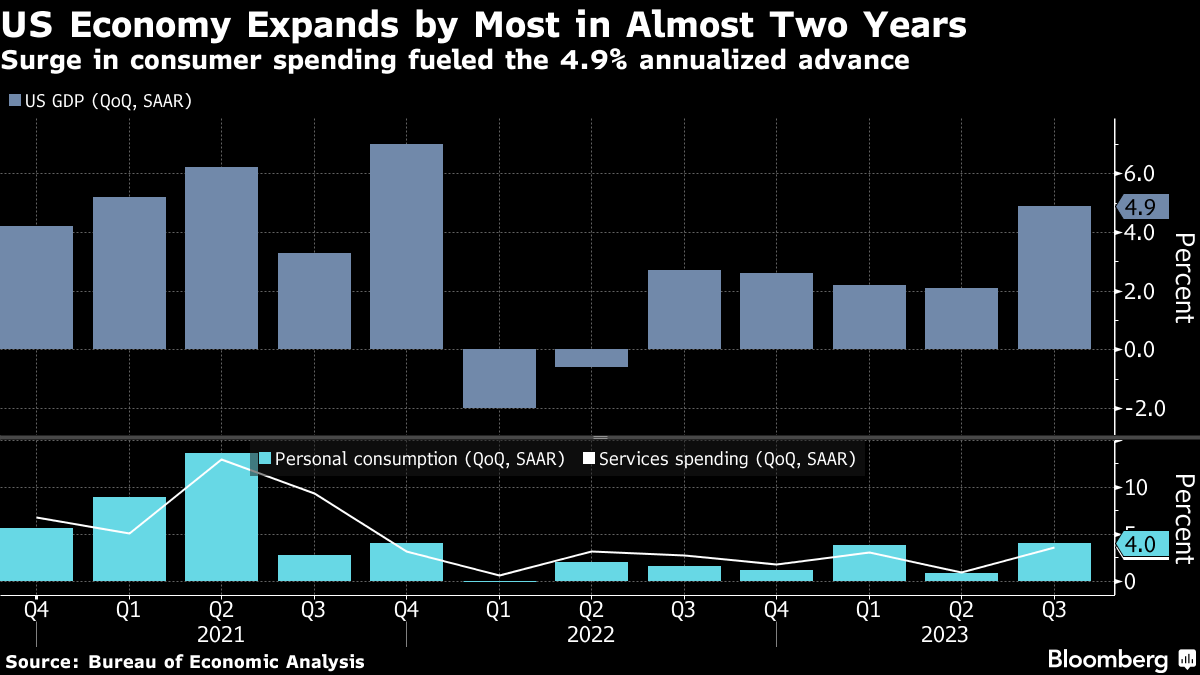

The more modest than-anticipated expansion in week by week jobless cases announced by the Labor Office on Thursday followed late information showing retail deals suddenly ascending in November, while single-family lodging starts and building grants scaled 1-1/2-year highs. Those reports incited financial specialists to help their development gauges for the final quarter.

The economy had showed up at risk for slowing down toward the beginning of the quarter. There was considerably more uplifting news on expansion, with different information on Thursday showing essentially more headway made toward returning it to the Central bank’s 2% objective in the second from last quarter than recently announced.

“There is a lot to cheer about the economy, and one year from now ought to be far superior as the Central bank takes the brakes off the economy now that expansion is turning out well for them,” said Christopher Rupkey, boss financial specialist at FWDBONDS in New York.

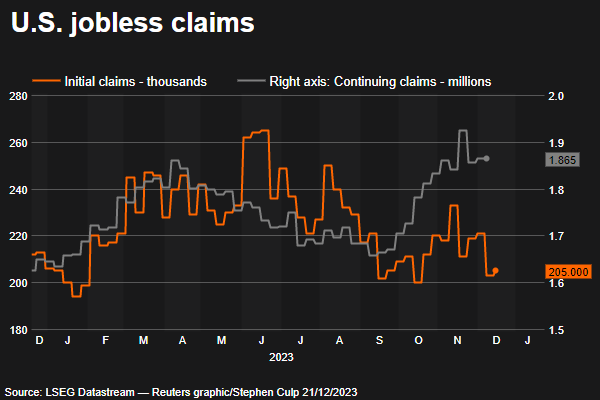

Starting cases for state joblessness benefits expanded 2,000 to an occasionally changed 205,000 for the week finished Dec. 16. Financial analysts surveyed by Reuters had estimate 215,000 cases for the most recent week. Unadjusted cases fell 9,225 to 239,865 last week as huge decreases in California and Georgia more than offset a sizeable expansion in Ohio.

However the cases information are unpredictable close to this season in light of occasions, they stay reliable with a genuinely sound labor market, as would be considered normal to keep the economy from downturn one year from now. A study from the Meeting Board on Wednesday showed the portion of shoppers seeing position as copious was the most elevated in five months in December.

The cases information covered the week during which the public authority overviewed organizations for the nonfarm payrolls part of December’s business report. Claims fell somewhat between the November and December review periods.

The economy added 199,000 positions in November, less than the month to month normal of 240,000 throughout the last year, however more than the 150,000 positions made in October.

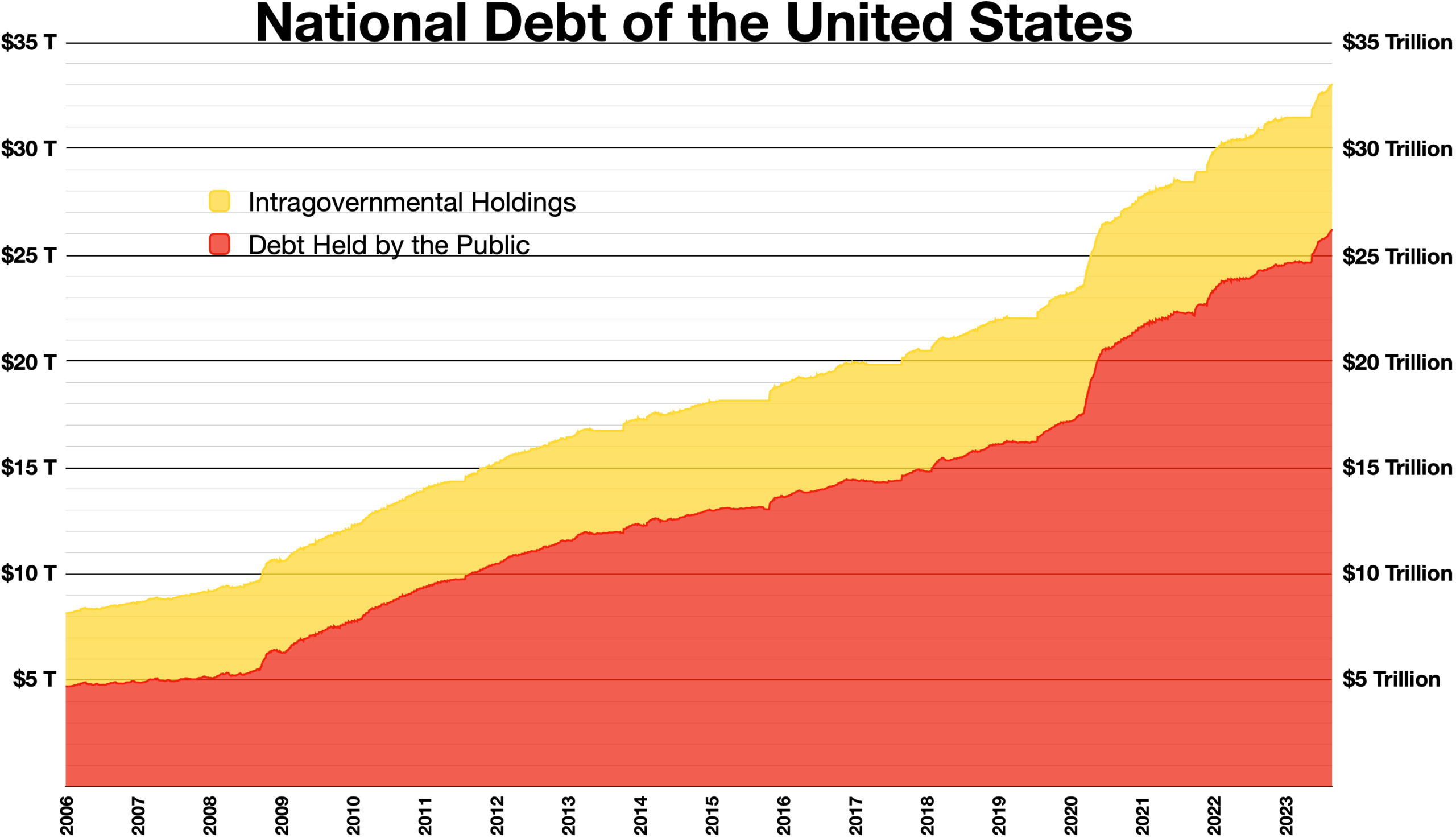

The Fed held loan fees consistent last week and policymakers motioned in new financial projections that the noteworthy money related arrangement fixing designed throughout the course of recent years is at an end and lower getting costs are coming in 2024. Since Walk 2022, the U.S. national bank has climbed its arrangement rate by 525 premise focuses to the ongoing 5.25%-5.50% territory.

Stocks on Money Road were exchanging higher. The dollar fell against a bin of monetary forms. U.S. Depository yields rose.